Energy review ahead - biggest issue to be ducked?

More well-briefed speculation in the papers about this coming week's Energy Review see The Observer Revealed: Blair's energy blueprint following a hefty run through in the FT last week - with each paper given a cut of the announcement best calculated to charm or sedate its readership - the Observer got the scoop on renewables and the FT the removal of tiresome planning obstacles that stand in the way of nuclear power stations. The high price of gas and improved designs, mean the government can now declare nuclear is 'economic' when it wasn't in 2003 and now conveniently needs no subsidy. All that's needed is some tidying up of licensing, planning and commercial back-end liabilities arrangements and they'll be going up like branches of Starbucks. But that really be enough?

More well-briefed speculation in the papers about this coming week's Energy Review see The Observer Revealed: Blair's energy blueprint following a hefty run through in the FT last week - with each paper given a cut of the announcement best calculated to charm or sedate its readership - the Observer got the scoop on renewables and the FT the removal of tiresome planning obstacles that stand in the way of nuclear power stations. The high price of gas and improved designs, mean the government can now declare nuclear is 'economic' when it wasn't in 2003 and now conveniently needs no subsidy. All that's needed is some tidying up of licensing, planning and commercial back-end liabilities arrangements and they'll be going up like branches of Starbucks. But that really be enough?

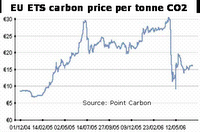

If the specualion is right, the big question is likely to be ducked... how can the energy market value carbon over the longer term? The speculation points to government reliance on talking up the future of the emissions trading system (ETS), but this is far from adequate. But it's hard to fathom what a realistic price should be: ETS prices are very volatile (see chart) and determined by policy choices rather than fundamentals. There is little that can be known about the future ETS design, the future emissions caps or even membership of the ETS after 2012. What is needed is some sort of mechanism that gives investors a longer-term view of a reasonably robust carbon price - ie. the government reduce the 'policy risk' faced by investors. My own preference is for Long term carbon contracts or some sort of cross-party 'policy guarantee' that would underwrite a carbon price of, say, €20/tonne to 2030 - nice and simple, and costs recovered at the time through a carbon tax or auctioning allowances in the ETS. If they were serious about it, that's what they do... but are they?

1 comment:

Chris, I guess the consumer, taxpayer or shareholder always pays and always bears the risk. The trick will be to make it the consumer. There are clues to how a new nuclear programme could be financed... there is quiet talk of a consortium. Given there are really three dominant players (E.ON, RWE and EDF - maybe Scottish Power too), one possible model would be for these to form a consortium (er, that's one word for it). Any costs/risks would be passed through to the consumer through suspension of competition rules and market power. What could be easier... re-establish the CEGB by stealth and have it sell nuclear electricity to itself at a bulk supply tariff of its own choosing.

Post a Comment