Environmental markets - long, loud and legal please

An excellent report from Vivid Economics, titled The business opportunities for SMEs in tackling the causes of climate change, done for Shell's Springboard programme.

An excellent report from Vivid Economics, titled The business opportunities for SMEs in tackling the causes of climate change, done for Shell's Springboard programme.

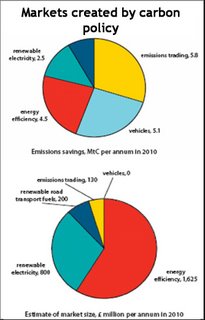

The particularly good thing about it is that it shows in clear terms how a market for environmental goods and services forms - primarily through policy interventions, as 'the environment' doesn't establish a demand and pay in its own right. The chart shows the expected environmental value of the policy intervention in avoided carbon emissions (top) and the expected value of the market for environmental goods and services thereby created in £million (bottom).

Long, loud and legal - the value of strong interventions

It's because of this market-making function that forward-looking business groups (eg, WBCSE) call for the policy framework to be 'long, loud and legal' - if the signals from environmental policy are sufficiently long-term, clear in intent, and intolerant of free-riding then they will stimulate investment and R&D to meet future demand. Campaigners also see the role of policy and regulation as moving 'From Red Tape to Road Signs'. Yet this seems to be what policymakers are reluctant to do... often seeing 'innovation policy' as direct government spending on R&D or dealing with failures in the venture capital market (see DTI innovation pages for a flavour - very little mention of the importance of the government acting clearly and consistently).

100,000 jobs would be nice... but what will create them?

In his 2006 conference speech, the Chancellor announced: I will publish proposals this autumn showing how environmental care and job creation advance together: from energy saving, innovation and green technologies. At least 100,000 new jobs for British people.

One of the most important ways to cause this to happen would be to clear about the direction of environmental policy, especially for carbon. In the case of the long term market for low carbon there remains great uncertainty and very ambiguous signals to investors. The Energy Review chapter on 'Valuing Carbon' did little more than make statements of intent about the future of the EU Emissions Trading System (which UK cannot deliver on) and left us with the following: We will keep open the option of further measures to reinforce the operation of the EU ETS in the UK should this be necessary to provide greater certainty to investors.

It doesn't even say when and how 'necessity' would be judged. It also reminds investors that the are several forces that make the prices even less certain in the future - the role of the Clean Development Mechanism and joint implementation etc (making cheaper emissions reductions outside the ETS system - but adding uncertainty to future prices.

Uncertainty or credibility?

Dieter Helm's discussion of Credible Carbon Policy and his proposals for Carbon Contracts to give a clearer signal for long term carbon policy should be required reading for the Chancellor's team, as they work out how to generate 100,000 jobs. It will need more than the recently announced Environmnetal Transformation Fund (details to follow...!) and a few spending initiatives to deliver really vibrant environmental markets...

The Vivid Economics report concludes:On the basis of the UK Government’s plans to tackle climate change (the compliance market) and the emerging voluntary market, the UK market opportunity alone will be worth £4 billion a year by 2010. The compliance market resulting from the UK Government's climate change programme over the next 10 years will be worth around £30 billion or more. The compliance market is growing primarily because the UK is tightening building standards, bringing forward renewable electricity and biofuel schemes, and tackling the energy efficiency of dwellings.

There's a lot money in environmental policy, and the strongest driver of national comparative advantage will the quality and strength of policy signals to UK firms - ie. intervention. That's a difficult and counter-cultural idea for policy makers that have spent years sympathising with businesses about 'regulatory burdens' and red tape.

No comments:

Post a Comment